- prepare data and packages

- Draw data to see the overview

- ADF test for checking the series stable or not

- Make series data Stationary

- Prediction: ARIMA model

- Go back to the origin data

prepare data and packages

Pandas has dedicated libraries for handling TS objects, particularly the datatime64[ns] class which stores time information and allows us to perform some operations really fast. Lets start by firing up the required libraries:

# -*- coding:utf-8 -*-

import pandas as pd

import numpy as np

import matplotlib.pylab as plt

from statsmodels.tsa.stattools import adfuller

from matplotlib.pylab import rcParams

rcParams['figure.figsize'] = 15, 6

from statsmodels.tsa.arima_model import ARIMA

from statsmodels.tsa.seasonal import seasonal_decompose

from statsmodels.tsa.stattools import acf, pacf

# 设置时间格式

dateparse = lambda dates: pd.datetime.strptime(dates, '%Y-%m')

# 读取数据时,见时间设置作为索引

data = pd.read_csv('AirPassengers.csv', index_col='Month',date_parser=dateparse)

ts = data['#Passengers']

Draw data to see the overview

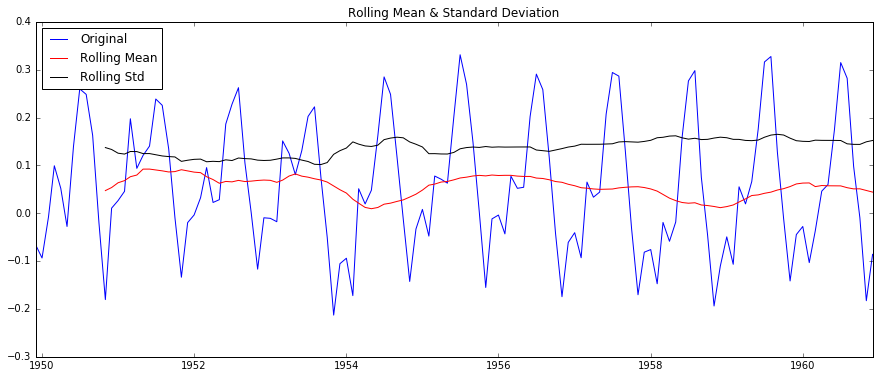

def draw(timeseries):

rolmean = pd.rolling_mean(timeseries, window=12)

rolstd = pd.rolling_std(timeseries, window=12)

orig = plt.plot(timeseries, color='blue', label='Original')

mean = plt.plot(rolmean, color='red', label='Rolling Mean')

std = plt.plot(rolstd, color='black', label='Rolling Std')

plt.legend(loc='best')

plt.title('Rolling Mean & Standard Deviation')

plt.show()

plt.plot(ts)

ADF test for checking the series stable or not

# ADF 检验

def test_stationarity(timeseries):

# Perform Dickey-Fuller test:

print 'Results of Dickey-Fuller Test:'

dftest = adfuller(timeseries, autolag='AIC')

dfoutput = pd.Series(dftest[0:4], index=['Test Statistic', 'p-value', '#Lags Used', 'Number of Observations Used'])

for key, value in dftest[4].items():

dfoutput['Critical Value (%s)' % key] = value

print dfoutput

The result is:

Results of Dickey-Fuller Test:

Test Statistic 0.815369

p-value 0.991880

#Lags Used 13.000000

Number of Observations Used 130.000000

Critical Value (5%) -2.884042

Critical Value (1%) -3.481682

Critical Value (10%) -2.578770

dtype: float64

Note that the signed values should be compared and not the absolute values.

Make series data Stationary

# method 1: One of the first tricks to reduce trend can be transformation.

# 对数变换

ts_log = np.log(ts)

# 移动平均数,原序列去除移动平均,此处使用12个月的平均数

def delMoving_avg(timeseries):

moving_avg = pd.rolling_mean(timeseries, 12)

ts_log_moving_avg_diff = timeseries - moving_avg #此处是从12月前开始,没有对前11个月定义,非数字

ts_log_moving_avg_diff.dropna(inplace=True)

# ADF 检验

test_stationarity(ts_log_moving_avg_diff)

# 绘制移动平均数和去除后的效果图

plt.subplot(211)

plt.plot(timeseries)

plt.plot(moving_avg, color='red')

plt.subplot(212)

plt.plot(ts_log_moving_avg_diff)

plt.show()

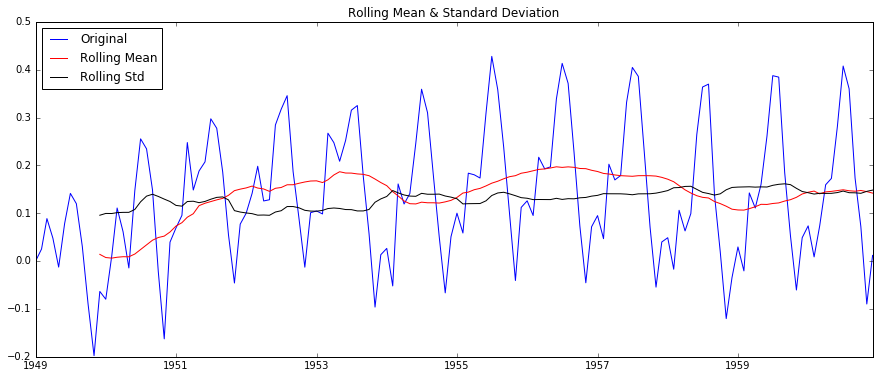

# 指数加权移动平均数,原序列去除指数加权移动平均,此处使用12个月的平均数

def delexpMoving_avg(timeseries):

expwighted_avg = pd.ewma(timeseries, halflife=12)

ts_log_moving_avg_diff = timeseries - expwighted_avg #此处是从12月前开始,没有对前11个月定义,非数字

ts_log_moving_avg_diff.dropna(inplace=True)

# ADF 检验

test_stationarity(ts_log_moving_avg_diff)

# 绘制移动平均数和去除后的效果图

plt.subplot(211)

plt.plot(timeseries)

plt.plot(expwighted_avg, color='red')

plt.subplot(212)

plt.plot(ts_log_moving_avg_diff)

plt.show()

# 差分

def delshift(timeseries):

ts_log_diff = timeseries.shift()

ts_log_moving_avg_diff = timeseries - ts_log_diff #此处是从12月前开始,没有对前11个月定义,非数字

ts_log_moving_avg_diff.dropna(inplace=True)

# ADF 检验

test_stationarity(ts_log_moving_avg_diff)

# 绘制移动平均数和去除后的效果图

plt.subplot(211)

plt.plot(timeseries)

plt.plot(ts_log_diff, color='red')

plt.subplot(212)

plt.plot(ts_log_moving_avg_diff)

plt.show()

# method 2: smoothing

delMoving_avg(ts_log)

delexpMoving_avg(ts_log)

# method 3: differences

delshift(ts_log)

Removing the differences, you can get the images:

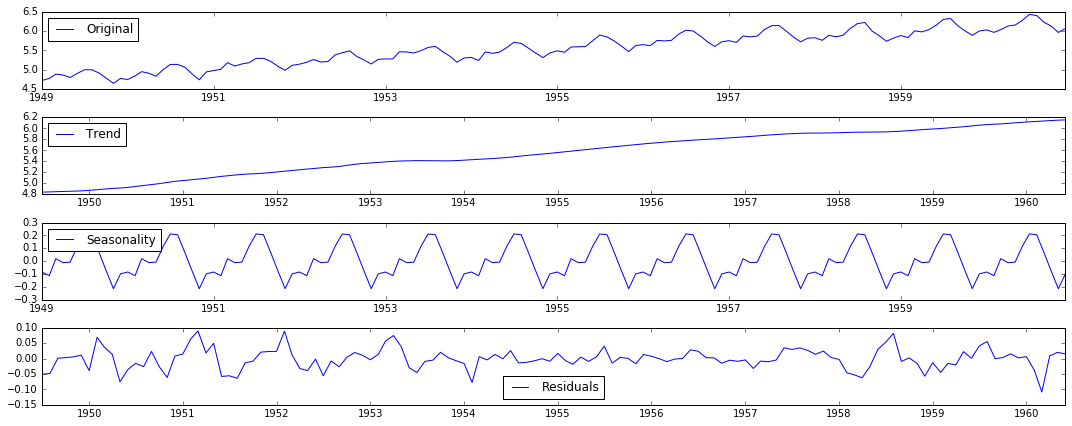

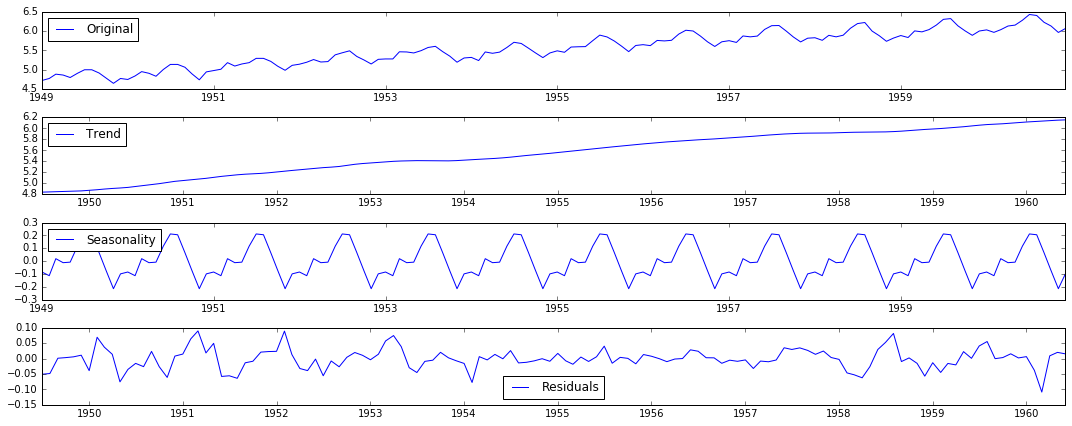

method 4: Decomposition

# 分解

def residuals(timeseries):

decomposition = seasonal_decompose(timeseries)

trend = decomposition.trend

seasonal = decomposition.seasonal

residual = decomposition.resid

plt.subplot(411)

plt.plot(timeseries, label='Original')

plt.legend(loc='best')

plt.subplot(412)

plt.plot(trend, label='Trend')

plt.legend(loc='best')

plt.subplot(413)

plt.plot(seasonal, label='Seasonality')

plt.legend(loc='best')

plt.subplot(414)

plt.plot(residual, label='Residuals')

plt.legend(loc='best')

plt.tight_layout()

plt.show()

ts_log_decompose = residual

ts_log_decompose.dropna(inplace=True)

test_stationarity(ts_log_decompose)

The decomposition diagram

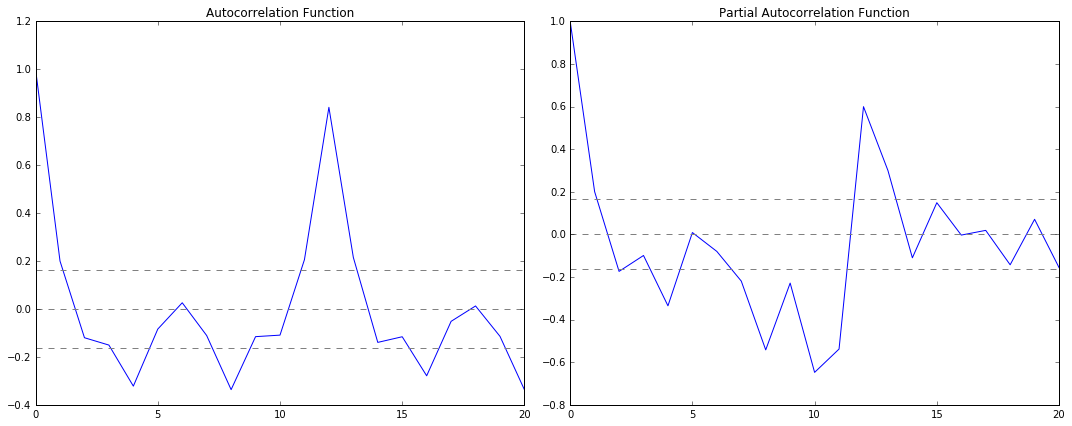

Prediction: ARIMA model

Before the prediction, we have to use ACF and PACF to check the ARIMA parameter p and q.

# 绘制自回归函数确定p值

def plotacf(ts_log_diff):

lag_acf = acf(ts_log_diff, nlags=20)

plt.plot(lag_acf, color='red')

plt.axhline(y=0, linestyle='--', color='gray')

plt.axhline(y=-1.96 / np.sqrt(len(ts_log_diff)), linestyle='--', color='gray')

plt.axhline(y=1.96 / np.sqrt(len(ts_log_diff)), linestyle='--', color='gray')

plt.title('Autocorrelation Function')

plt.show()

# 绘制部分自回归函数确定q值

def plotpacf(ts_log_diff):

lag_pacf = pacf(ts_log_diff, nlags=20, method='ols')

plt.plot(lag_pacf, color='red')

plt.axhline(y=0, linestyle='--', color='gray')

plt.axhline(y=-1.96 / np.sqrt(len(ts_log_diff)), linestyle='--', color='gray')

plt.axhline(y=1.96 / np.sqrt(len(ts_log_diff)), linestyle='--', color='gray')

plt.title('Autocorrelation Function')

plt.show()

As we can see ,

p – The lag value where the PACF chart crosses the upper confidence interval for the first time. If you notice closely, in this case p=2.

q – The lag value where the ACF chart crosses the upper confidence interval for the first time. If you notice closely, in this case q=2.

Now you can try different AR, MA, ARMA model.

# 绘制ARIMA模型,并计算残差值

def plotARIMA(timeseries, p, d, q):

model = ARIMA(timeseries, order=(p, d, q))

ts_log_diff = timeseries - timeseries.shift()

ts_log_diff.dropna(inplace=True)

results= model.fit(disp=-1)

plt.plot(ts_log_diff)

plt.plot(results.fittedvalues, color='red')

plt.title('RSS: %.4f' % sum((results.fittedvalues - ts_log_diff) ** 2))

plt.show()

return results

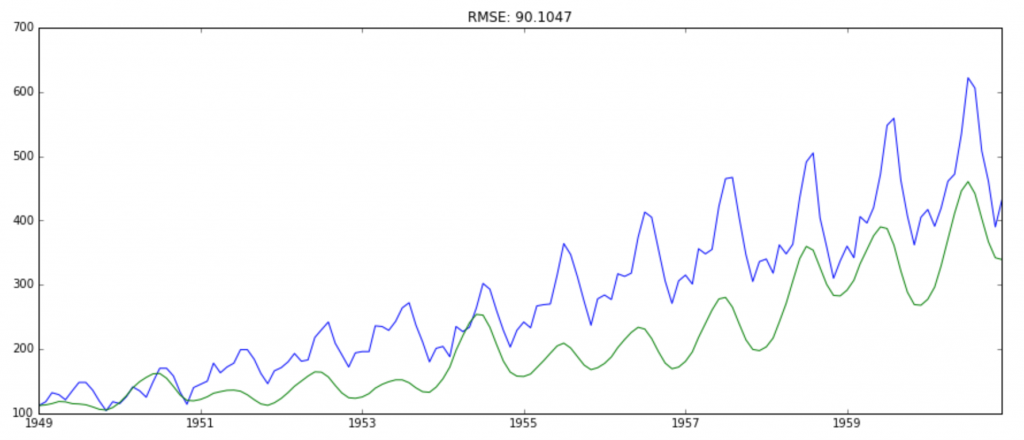

Go back to the origin data

# 回到源数据

def backPredict(results_ARIMA, ts_log, ts):

predictions_ARIMA_diff = pd.Series(results_ARIMA.fittedvalues, copy=True)

# 计算累计和

predictions_ARIMA_diff_cumsum = predictions_ARIMA_diff.cumsum()

predictions_ARIMA_log = pd.Series(ts_log.ix[0], index=ts_log.index)

predictions_ARIMA_log = predictions_ARIMA_log.add(predictions_ARIMA_diff_cumsum, fill_value=0)

predictions_ARIMA = np.exp(predictions_ARIMA_log)

plt.plot(ts)

plt.plot(predictions_ARIMA)

plt.title('RMSE: %.4f' % np.sqrt(sum((predictions_ARIMA - ts) ** 2) / len(ts)))